The Benefits of Compound Interest in Savings and Investments: Unlocking Financial Growth

Compound interest is a powerful financial concept that can significantly impact your savings and investments. By understanding how compound interest works and harnessing its potential, you can achieve accelerated growth and long-term financial success. In this article, we will delve into the definition of compound interest and highlight its importance in savings and investments.

How Compound Interest Works

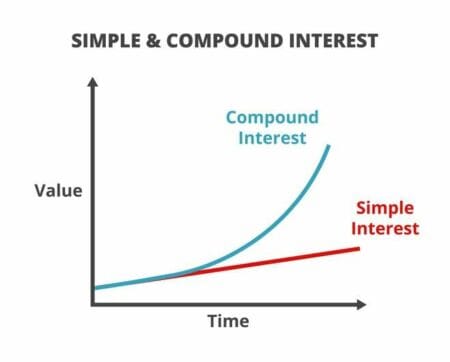

Compound interest refers to the process of earning interest on both the initial principal amount and the accumulated interest. It allows your money to grow exponentially over time.

- Initial Principal: Compound interest begins with an initial principal, which is the amount of money you invest or deposit. This could be the starting balance in a savings account or the principal amount invested in an investment vehicle like stocks, bonds, or mutual funds.

- Interest Rate: The interest rate is a percentage that represents the cost of borrowing or the return on investment. It determines how much interest you will earn or owe over a specific period. The higher the interest rate, the faster your money will grow through compounding.

- Compounding Frequency: Compounding frequency refers to how often interest is calculated and added to your principal. It can occur annually, semi-annually, quarterly, monthly, or even daily, depending on the financial institution or investment vehicle. The more frequently interest is compounded, the more significant the growth potential.

- Accumulated Interest: As time progresses, the interest earned on your initial principal is added to the principal itself. This accumulated interest becomes part of the new base on which future interest calculations are made. In other words, you earn interest on both the original principal and the previously earned interest.

- Exponential Growth: The compounding effect leads to exponential growth over time. As interest is continuously added to the principal, the overall amount grows at an increasing rate. The longer the investment or saving period, the more pronounced the compounding effect becomes, resulting in substantial growth over the long term.

Benefits of Compound Interest in Savings:

- Accelerated growth of savings over time: When you save money in an account that earns compound interest, such as a high-yield savings account or a certificate of deposit (CD), your savings grow faster compared to simple interest. The longer you save, the more pronounced the growth becomes.

- Snowball effect: Increasing returns over the long term: Compound interest has a snowball effect, where the interest earned is reinvested and added to the principal amount. As a result, your savings continue to grow at an increasing rate. Over time, this compounding effect can lead to substantial wealth accumulation.

- Power of compounding and exponential growth: Compound interest harnesses the power of compounding, enabling your savings to grow exponentially. As the interest is reinvested and earns additional interest, your savings multiply over time. This compounding growth can significantly boost your financial goals.

Benefits of Compound Interest in Investments:

- Amplifying investment returns: Compound interest can amplify investment returns, especially when investing in assets that offer compounding benefits, such as stocks, bonds, or mutual funds. By reinvesting dividends or capital gains, you can leverage compound interest to maximize your investment growth. Capital appreciation and wealth accumulation:Investments subject to compound interest have the potential for capital appreciation. As your investment grows, the value of your holdings increases, leading to wealth accumulation. Compound interest plays a crucial role in magnifying the growth of your investment portfolio.

- Diversification and risk management: Compound interest incentivizes long-term investing, which promotes diversification and risk management. By spreading your investments across different asset classes, you can reduce the impact of market volatility and achieve more consistent returns over time.

- Start saving and investing early: One of the most effective strategies for maximizing compound interest is to start early. The earlier you begin saving and investing, the longer your money has to compound and grow. Time is a powerful ally when it comes to compound interest.

- Consistent contributions and automatic investments: Consistency is key in harnessing the benefits of compound interest. Regular contributions to your savings or investment accounts, coupled with automatic investment plans, ensure that your money continues to compound over time.

- Taking advantage of tax-advantaged accounts: Utilizing tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k) plans can supercharge your compound interest gains. These accounts offer tax benefits, allowing your investments to grow tax-free or tax-deferred, further boosting your savings and investments.

- Reinvesting dividends and interest: When you receive dividends or interest from your investments, consider reinvesting them instead of cashing them out. By reinvesting these earnings, you allow them to compound and contribute to the growth of your investment portfolio over time.

- Illustrative examples of compound interest in action:

- Comparison of different savings and investment scenarios:

- Higher Interest Rates: When it comes to compound interest, higher interest rates can significantly impact the growth of your investments or savings. A higher interest rate means a larger portion of your principal is added as interest during each compounding period. As a result, your money grows at a faster rate. It’s important to compare the interest rates offered by different financial institutions or investment options and choose the ones that provide competitive rates. By selecting options with higher interest rates, you can maximize your compound interest earnings over time.

- More Frequent Compounding: Compounding frequency refers to how often interest is added to the principal and reinvested. The more frequent the compounding, the more opportunities your money has to grow. For instance, an investment that compounds interest annually will grow at a slower rate compared to an investment that compounds interest monthly or daily. It’s beneficial to opt for options that offer more frequent compounding periods to accelerate the growth of your compound interest.

- Longer Time Horizon: Time is a crucial factor in the power of compound interest. The longer your money remains invested, the more time it has to compound and generate substantial returns. Starting early and staying invested for a longer time allows your investments or savings to experience the compounding effect over multiple compounding periods. The compounding effect becomes more pronounced over an extended period, leading to accelerated growth.

- Extended Investment Period: The duration of your investment period also plays a significant role in the growth of compound interest. The longer you keep your money invested, the more it can benefit from compounding. Consistently contributing to your investments over an extended period can amplify the impact of compound interest and lead to substantial wealth accumulation.

Strategies for Maximizing Compound Interest:

Real-Life Examples and Case Studies:

Let’s consider a hypothetical example to illustrate the power of compound interest. Suppose you start with an initial investment of $10,000 with an annual compounding interest rate of 6%. After 10 years, your investment would grow to approximately $17,908. If you extend the investment period to 20 years, the value would increase to around $32,071. This showcases the significant impact of compound interest over time.

To further emphasize the benefits of compound interest, let’s compare two scenarios. In Scenario A, an individual starts saving and investing at the age of 25, contributing $200 per month until retirement at 65. In Scenario B, another individual delay saving until the age of 35 but doubles the monthly contribution to $400. Despite contributing more, Scenario B ends up with a smaller overall amount due to the shorter compounding period. This highlights the importance of starting early to take full advantage of compound interest.

Factors that Influence Compound Interest:

Interest rates and compounding frequency:

Time horizon and investment period:

Contribution amounts and frequency:

The amount and frequency of your contributions also influence the benefits of compound interest. Consistent and higher contributions result in more significant growth over time. Aim to increase your savings and investment contributions whenever possible to maximize the potential of compound interest.

Compound interest is a fundamental concept that can greatly benefit your savings and investment endeavors. By understanding how compound interest works and implementing strategies to maximize its potential, you can experience accelerated growth, capital appreciation, and long-term wealth accumulation. Starting early, making consistent contributions, diversifying your investments, and taking advantage of tax-advantaged accounts are all key components of leveraging compound interest for financial success. Embrace the power of compound interest and embark on a journey toward a brighter financial future.