By Peter Askew, Fund Manager and CEO at T. Bailey Asset Management Limited

That Time of Year

As we are in the two month ‘sweet spot’ of passing the deadline for tax returns for the previous tax year and the end of the current financial year for personal tax purposes, many people choose this period to look at starting or topping up their Individual Savings Accounts (ISAs), using their annual allowance of £15,240 or part thereof.In the next tax year, 2017/18, that amount rises to £20,000. Given that capital gains and much of the income generated within ISA investments is tax-free, they would seem to be a fairly tax-efficient way of investing. They are. After all, you would expect investments in most asset classes to have appreciated over a reasonable length of time – a few years.

Responsibility – Over to You

Clearly, the current government is keen on individuals boosting their savings pots by increasing the annual ISA allowance for the tax year, 2017/18 to £20,000. The need to save more is never far from the financial media’s output. In recent years, the launch of auto enrollment has meant more people in work have started a pension. Another shift in pensions that started years before, was the move away from Defined Benefit (DB) pension schemes. In these schemes, the obligation to provide an income in retirement and consequently the investment responsibility resided with the employer. Now, however,Defined Contribution (DC) schemes are more prevalent and the investment responsibility lies with the employee or individual, albeit with some guidance from the employer and their advisers via approved investment choices. The shift to the employee having ‘ownership’ of their pension liability is a plus for the employer, as they do not have to take on the responsibility and carry these pension liabilities on the company balance sheet.

As with ISAs, the DC savings responsibility is with the investor. Pension contributions can be tax-efficient on the way in, whereas ISAs are tax-efficient on exit. Pensions are out of reach tax efficiently until you reach the age of fifty-five whereas ISAs accrue tax efficiencies from day one and are readily accessible. Of course, having the discipline to access your ISA savings ‘appropriately’ and not deplete them as part of your overall savings pot is down to you, the individual. Having a combination of a pension and ISA savings looks a good option going forward and regular saving takes out the requirement of having a ‘market view’. But what are we saving for?

Plan

The idea about saving for retirement is to achieve a reasonable standard of living depending on how you want to spend your time or money, how you may want to plan for unforeseen costs and/or what you want to leave as a legacy. Whereas it used to be about saving to retirement, today’s savings and their intended uses require more planning.

To or Through

Having previously worked for a US investment company and a pioneer in the 401k (the US Defined Benefit equivalent) market, means familiarity with the debates surrounding what timeframe you should be saving for. Should you save to retirement or through retirement? What about covering the cost of healthcare or care of the elderly?

The saving to retirement school spawned a number of lifestyle funds built on passives or index trackers, allocating more to bonds as you near retirement with a mind to ‘de-risking’ before the need to purchase an annuity. Those were the days before quantitative easing (QE) when government bonds had a positive real yield (above inflation) as did their index-linked equivalents. Today, that is not the case and bonds may carry as much investment risk as other asset classes.

Lifestyle funds haven’t really taken off in the UK, possibly because there are more investors looking beyond or through their retirement date. The norm was that you retired at 65 (the current state retirement age) and you expected to live around 20 more years. Your pension pot covered that period or an annuity did. Gone is the necessity to buy an annuity when you reach 75.

On reaching retirement age today, consideration needs to be given to not just how you want to live and for how long that might be, but what you might want to make provision for and I’m not talking about those rather annoying funeral ads that appear on afternoon TV.

Consider that:

- A man retiring at 65 is expected to live to 87, a woman to 89.

- One in four over the age of 65 will enter residential care.

- 58% of 65 – 74 year olds in the UK reported a long-standing illness or disability.

Sources:

- Cohort expectation of life: Life Tables, Principal Projection, UK, 2014-based, ONS, 11th December 2015. https://www.ons.gov.uk/file?uri=/peoplepopulationandcommunity/birthsdeathsandmarriages/lifeexpectancies/datasets/expectationoflifeprincipalprojectionengland/2014based/wengprincipal14.xls.

- Green Paper from the Secretary of State for Health (Shaping the Future of Care Together) 2009.

- ONS: General Lifestyle Survey Overview – A report on the 2011 General Lifestyle Survey. March 2013.

With acknowledgement to Artemis Fund Managers.

Income or Outcome?

The default option for many on reaching retirement has been to invest in products that provide a suitable income. Historically they might have been UK government bonds (gilts) or similar forms of fixed income or debt securities. However, QE, where central banks have created money to buy financial assets, has sent the yields on those traditionally ‘safe’ assets to extremely low levels, in many cases below the Bank of England’s 2% target inflation rate. The hunt for yield has driven many investors to assume greater investment risk by either buying into longer dated bonds that pay a slightly higher yield or seeking out higher dividend paying equities to sustain a given yield. The desire for the retiree is to keep the retirement pot intact and live off the natural income derived from it. However, keeping the savings pot intact in nominal terms does not mean it will remain intact in real terms once the effects of inflation are considered.

In an industry awash with so much product, investment providers have been quick to seize the opportunity and offer income products. Equity income products have been launched to fill the gap made by the expensiveness of bonds. Of course, the dividends of companies in those products need to be sustainable and dividends can vary. Furthermore, the ability to generate returns from longer-term capital growth are often downplayed in favour of natural income generating assets.

Consider the retiring investor mentioned earlier who seeks a particular yield to fund his/her annual living expenditures. He/she may take more risk to maintain that income putting capital at risk and capital that might be needed to cover healthcare costs at a later date, in jeopardy. The pot remains intact but only nominally, inflation – however low – chips away at the pot.

Consider instead an investment solution that seeks to deliver a total return of UK inflation plus a margin over market cycles through investing in a diverse combination of financial assets with the aim of delivering that outcome, taking on the asset allocation decisions and the choices of investments. The investor could then spend the returns achieved in excess of inflation through a sustainable draw down of capital and income (tax-free if held within an ISA) while the collective value of the investments is not reduced in real terms over time (assuming the target investment objective is achieved).

You could then retire when you felt you had enough in your pot. Remember that your pension lifetime allowance is capped at £1 million but ISAs are not capped in total (just by annual allowance).

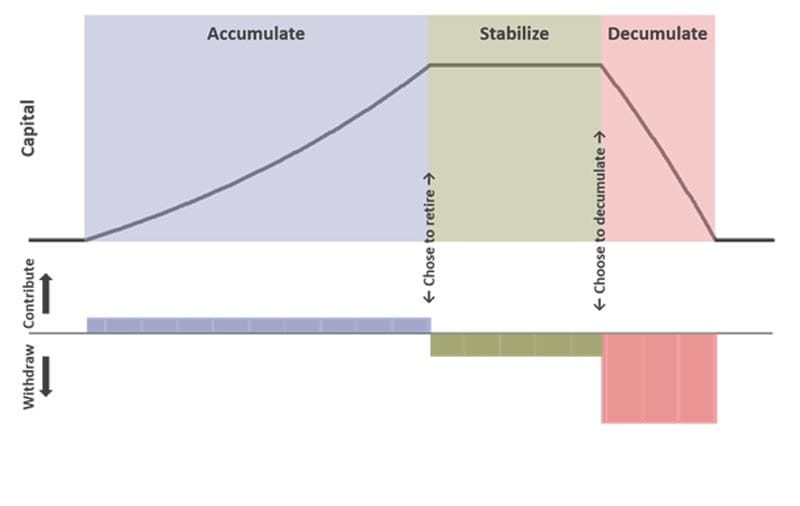

So rather than thinking in terms of ‘accumulate then decumulate’, one can think instead of accumulating until you believe you have enough savings, then stabilising your savings pot in real terms (using the margin over inflation to fund your post-retirement bucket list) before finally decumulating to fund care, provide a legacy or whatever you want.

Summary

ISAs are being promoted by the current government as a suitable and tax efficient investment vehicle through a generous annual allowance at the same time they have capped the lifetime pension allowance.

Investing in a solution, which aims to beat inflation over the long-term,via an ISA can be an attractive and flexible way of complementing a pension for long-term savings provision.

Important Notice

The above is not intended as financial or investment advice.

For overall financial planning, and to understand what investment products are suitable for your financial circumstances, please seek the services of an Independent Financial Adviser.

Peter Askew and Elliot Farley are fund managers at T. Bailey Asset Management Limited and manage the T. Bailey Dynamic Fund, which seeks to deliver UK Inflation plus 3% over a market cycle (3 to 5 years) after fees. The T. Bailey Dynamic Fund is available within an ISA wrapper.

Full details of the T. Bailey Funds, including risk warnings and charges, are published in the T. Bailey Funds’ Prospectus, the Key Investor Information Document and the Supplementary Information document.

The T. Bailey Funds are exposed to global financial markets and therefore are subject to market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested (i.e. the investment objective may not be achieved). You should therefore regard your investment as medium-to-long term.

Every effort is taken to ensure the accuracy of the data used in this article but no warranties are given. All sources TBAM unless otherwise stated.

Issued by T. Bailey Asset Management Limited. T. Bailey Asset Management Limited is authorised and regulated by the Financial Conduct Authority No. 190291 and is a member of The Investment Association.

Please note that T. Bailey Asset Management Limited do not provide financial advice to private individuals.

Registered in England and Wales No. 3720372. Registered Address 64 St. James’s Street, Nottingham, NG1 6FJ.