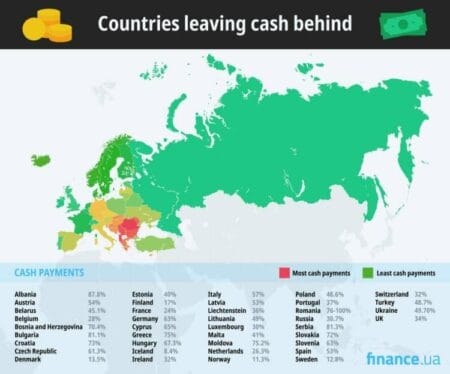

According to new figures, cash payments are on the decline across Europe as countries began leaving tangible currency behind.

The figures come from Finance.au’s research, after their experts analysed global trends.

Their analysis involved looking into the countries that have reported higher numbers of non-cash transactions.

They also found where in the world cash currency is holding on, to reveal the countries who are happy with tradition.

2021

In 2021, the Czech Republic saw the most amount of people ditching cash. This comes after a recorded decrease of 49% in cash payments – more than any other country.

However, using cash for purchases in Bulgaria is still popular, as the analysis revealed a decrease of 18% cash payments in the last two years.

Meanwhile, Sweden had the least amount of change in it’s numbers. Starting at an already low 13% of payments being made with cash, since 2019 the country has seen a reduction of nearly 11%.

Britain is following a similar trend but at a much slower pace.

The analysis showed that the island recorded a 21% drop in cash payments over the last two years, with the most significant decrease being between 2020 and 2021 of 10%.

2020

Seeing a drop in cash payments in 2020 is to be expected after multiple lockdowns across the countries.

But figures highlighted Denmark as being the country most affected as just 1% of all payments made by the Danes were made with cash.

The Czech Republic showed a similar trend. In comparison to 61% of payments being made with cash in 2019, the country’s cash payments dropped by 15% in 2020.

Regarding the amount of change seen in a country’s cash payments, Italy saw the biggest difference.

38% of the Italian’s payments were made with cash in 2020, in comparison to the 57% in 2019 – the pandemic may have been the cause of this 19% drop.

2019

2019 figures highlighted Iceland as leading the way for leaving cash in the past year.

So much so that 8% of the country’s overall payments were made with cash, leaving the Icelandic króna behind and becoming an almost cashless society. In fact, cash is even more redundant here as tipping for services and VAT taxes are always included in prices.

Figures showed that for some countries, there’s no clear ‘winner’.

In Ukraine, there’s an even split of cash and non-cash payments.

The research highlighted Romania and Albania as holding onto their cash instead of the electronic counterpart. 76-100% of Romanian’s made their payments made with cash during 2019 whilst 88% of Albanians’ purchases were made with cash.

However, analysis revealed that Finland actually saw an increase in cash payments between 2019 and 2020.

Figures showed that the country recorded a 7% increase in payments made with cash, going from 17% in 2019 to 24% in 2020.

Overall, these changes seem to reflect the constantly shifting landscape of electronic payment methods replacing traditional.

As countries across the world return to their ‘new normal’ and technology advances, perhaps we will see these figures shift. But a strong sense