The homecare and hospital sector are all set to take the medical devices market to a new level in the next decade. Growing geriatric population, technological advancements, and rising healthcare expenditure are there to drive the medical devices market. The latest trends on this count include an ever-increasing use of medical devices driven by AI, increasing usage of various miniaturized medical devices, wearable medical devices getting accepted at a large scale, and 3D printing getting adopted by and large.

Medical device coatings are catching up at a rapid pace with more number of people opting for home healthcare facilities. This could also be attributed to growing preference for minimally invasive surgical procedures. On the developments’ front, Hydromer, in Apr 2020, did enter into partnership with N8 Medical to supply coatings for CeraShield endotracheal tubes. It needs to be noted that the tubes do play an inevitable role in treating Covid-19 patients. Elsewhere, Surmodics and Abbott inked an agreement in 2018, for the latter to have commercialization rights for the former’s SurVeil drug-coated balloons.

Also, increasing incidences of chronic diseases like diabetes is driving the demand for disposable medical devices sensors. The advantages include low costs, quicker analysis and simplicity of use. Coming to sensors’ placement, they comprise wearable sensors, strip sensors, invasive sensors, implantable sensors, and ingestible sensors.

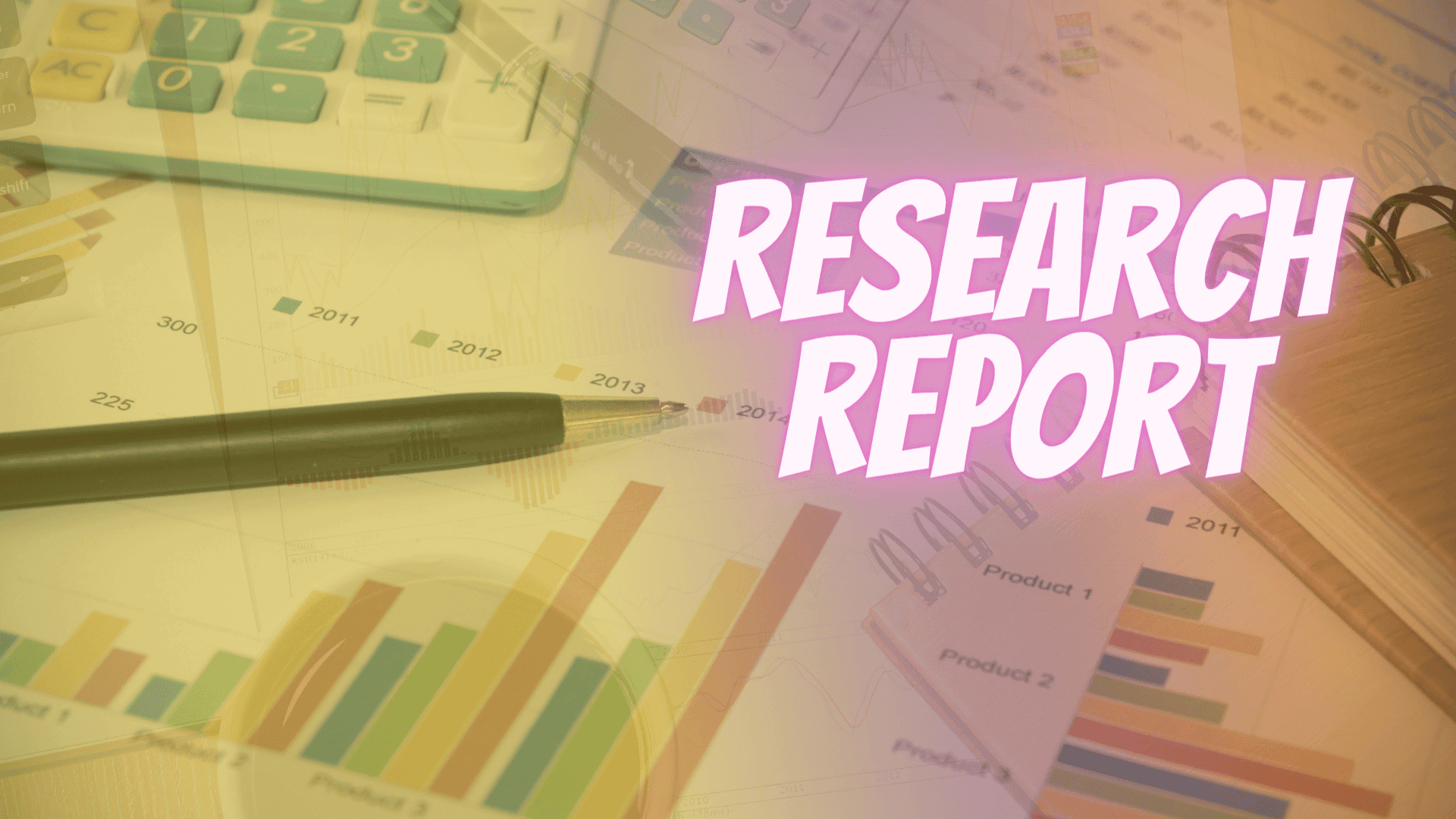

Going further, there are medical image analysis software’s available these days. Computer-aided diagnosis is the “new” normal. Type-wise, they could be standalone software and integrated software. Image-wise, they are 2D imaging, 3D imaging, and 4D imaging. By modality, they comprise TBI (Traumatic Brain Injury) (CT, MRI, PET, and SPECT), ultrasound imaging (2D, 3D/4D, and Doppler), radiographic imaging, and combined modalities (PET/MR, SPECT/CT, and PET/CT).

Sterile medical packaging is also the ongoing trend in medical devices market. Selection, application, and performance of sterile medical packaging systems is imperative, so that the contents could be withdrawn smoothly, that too, without infection. Material-wise, sterile medical packaging comprises polypropylene, plastics, polycarbonate, polystyrene, polyester, paperboard, stainless steel, aluminium foil, metal, glass, HDPE, and PVC. Application-wise, they are biological & pharmaceutical, medical & surgical instruments, medical implants sterile packaging, and in-vitro diagnostic products.

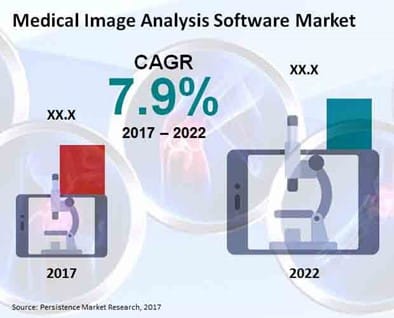

With homecare settings comes an increasing demand for medical oxygen systems like compressed oxygen cylinders and oxygen concentrators. The elderly population having problems with breathing is the major end-user to medical oxygen systems. Also, the fact that certain medical conditions like COPD, emphysema, chronic bronchitis need supplemental oxygen or oxygen therapy for getting enough oxygen. Along these lines, TherOx, in April 2019, did receive approval from the US FDA regarding supersaturated oxygen therapy offered by it.

Medical membrane devices encompass addressing more diseases like atherosclerosis, diabetes, and renal failure. The application areas include IV infusion filters, microfiltration, sterile filtration, and drug delivery. Of late, non-therapeutic uses like recovering concentrated proteins/enzymes are also are also poised to substantiate the medical membrane devices market between 2020 and 2030.

The sleep aid devices are being preferred; thanks to sedentary lifestyle and long working hours. Stress is inversely proportional to sleep. Product-wise, sleep aid devices consist of sleep laboratories, pillows & mattresses, sleep apnea devices, and medications. Medications are further sub-classified as herbal drugs, OTC (over-the-counter) drugs, and prescription-based drugs. As far as sleep disorders are concerned, these devices are sleep walking, narcolepsy, restless leg syndrome, sleep apnea, and insomnia.

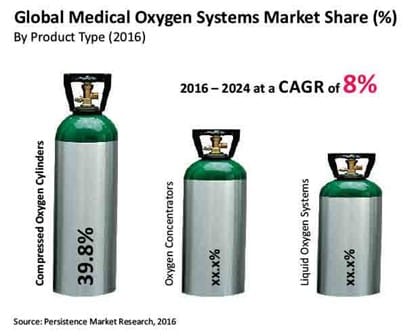

Besides, the construction and manufacturing industry calls for utmost safety of employees and workers. For example – regulatory bodies like NIOSH (National Institute for Occupational Safety), OSHA (Occupational Safety and Health Administration), and WHS (Work Health and Safety Regulations) have made it compulsory for the US-based organizations to abide by safety of the workforce. By product, hearing protection devices include earmuffs, hearing bands, uniform attenuation earplugs, and usual earplugs.

Enclosing the application areas and functionalities mentioned above, Persistence Market Research (PMR) has profiled the key players like:

- Johnson & Johnson

- Medtronic PLC

- General Electric Company

- Siemens AG

- Cardinal Health Inc.

- Biocoat

- Surmodics

- Hydromer

- DSM

- Omnivision Technologies, Inc.

- Philips N.V.

- Analog Devices, Inc.

- STMicroelectronics

- Freescale Semiconductors, Inc.

- Smiths Medical

- Merge Healthcare, Inc.

- Image Analysis

- Toshiba Medical Systems Corporation

- ScienceSoft USA Corporation

- MIM Software Inc.

- INFINITT Healthcare Co., Ltd.

- Luxfer Group

- GCE Group

- Precision Medical, Inc.

- BOC Healthcare

- Inogen, Inc.

- Cryofab, Inc.

Geography-wise, PMR has segregated the medical devices market into North America, Europe, LATAM, the Asia-Pacific, and MEA. It further states that North America holds the largest market share, followed by Europe. It has also mentioned that the Asia-Pacific is expected to change the equations in the years to come with the developing economies taking healthcare seriously on the whole.