The FinTech industry continues its rapid expansion, now valued at over $4 trillion globally and growing at a compound annual growth rate (CAGR) of 11%. As this sector evolves, the need for robust risk management and compliance strategies has never been more critical. At MPC 2024, a leading conference in the payments and commerce industry, Harsh Daiya, Staff Software Engineer at PayPal, was invited to take the stage as a Keynote Speaker to share his expertise on how data-driven approaches can help FinTech companies stay ahead of fraud and regulatory challenges.

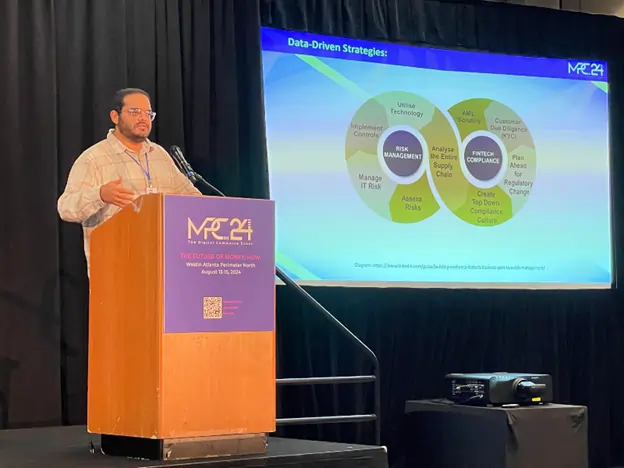

In his session, titled “Leveraging Data for Risk & Compliance in FinTech,” Harsh provided a comprehensive overview of how innovations in AI and data analytics are shaping the future of financial security. The FinTech landscape, he noted, is filled with both opportunity and responsibility, especially as companies gain access to vast amounts of customer and transaction data.

“In FinTech, access to vast customer and transaction data is both an opportunity and a responsibility. The stakes are high, and managing risk effectively is critical to maintaining trust in the industry,” Harsh emphasized to an audience keen on actionable insights.

Addressing Industry Needs

At the core of Harsh’s presentation was the idea that data is the lifeblood of FinTech. But with this comes the responsibility of protecting sensitive information while staying compliant with regulatory frameworks like GDPR and PSD2. The consequences of non-compliance are severe: GDPR violations can result in fines of up to €20 million or 4% of a company’s annual global turnover, whichever is higher. Operational restrictions and reputational damage further increase the stakes for FinTech firms.

“FinTech companies face significant consequences if they fail to comply with regulations. Whether it’s fines, reputational damage, or operational restrictions, the cost of non-compliance can cripple businesses,” Harsh warned, underscoring the critical nature of staying ahead of these challenges.

Harsh laid out the importance of identifying and mitigating financial risks through advanced data analytics. Predictive analytics and real-time monitoring have become indispensable in the fight against fraud and cyber threats. Harsh explained that these tools allow FinTech companies to foresee potential risks before they fully materialize, offering a proactive rather than reactive approach.

“Real-time monitoring combined with predictive analytics is now essential for identifying emerging risks. These technologies are transforming how we detect and prevent fraud, but the key lies in continuously evolving with the threats,” he added, reinforcing the need for constant vigilance in a rapidly shifting landscape.

Key Metrics and Real-World Examples

One of the key takeaways from Harsh’s talk was his focus on the importance of compliance in FinTech. The introduction of stricter regulations has made risk management a top priority for companies in the space. Non-compliance with regulations like GDPR and PSD2 not only incurs financial penalties but can lead to operational shutdowns. According to industry data, GDPR fines alone have already reached billions of euros in cumulative penalties, making it clear that compliance is no longer optional.

Harsh shared a specific example from his own experience at PayPal, where he led a migration of the company’s Risk Rules Engine from Amazon Web Services (AWS) to Google Cloud Platform (GCP). This move resulted in a $7 million cost-saving while improving the overall efficiency of PayPal’s risk management processes.

“The migration was a complex and challenging project, but the payoff was huge. Saving $7 million for the company was a significant achievement, but more importantly, it showed that we could innovate and adapt even in the face of substantial technical hurdles,” he explained.

The Role of AI in Fraud Prevention

As the conversation shifted toward fraud prevention, Harsh delved into how artificial intelligence (AI) is reshaping the way FinTech companies defend against threats. Fraud detection tools powered by AI can monitor and analyze vast amounts of transaction data in real time, enabling companies to flag suspicious activities before they escalate into serious issues.

Harsh highlighted that these tools are crucial not only for established companies like PayPal but also for smaller FinTech firms that may lack the resources to build in-house solutions. The threat of carding attacks, where fraudsters test the validity of stolen credit cards on vulnerable websites, remains a significant challenge. Harsh shared how his team at PayPal designed a module to protect merchants from such attacks, safeguarding small businesses that could otherwise face devastating financial losses.

“Carding attacks can devastate small businesses that lack the resources to defend themselves. Designing a solution that could help these merchants avoid such losses was incredibly rewarding. It’s about using technology to level the playing field and provide security for all, not just the big players,” Harsh explained.

Harsh’s Book: The Future of FinTech: AI in Risk Management and Fraud Prevention

While Harsh’s insights on risk management were invaluable, his contribution to the industry doesn’t stop at conference speaking engagements. His recently published book, The Future of FinTech: AI in Risk Management and Fraud Prevention, delves deeper into the role of AI in combating fraud and ensuring regulatory compliance.

Priced at just $1, the book is not only a resource for industry professionals but also aims to improve financial literacy for students and business readers who are navigating the FinTech landscape. By making the book affordable, Harsh hopes to bridge the knowledge gap in a field that can often feel inaccessible to newcomers.

“I wrote the book to fill a gap in accessible knowledge about AI’s role in FinTech. The goal is to make this critical information available to a wider audience, especially those entering the industry,” Harsh said, explaining his motivation behind the project.

The book has already received praise for its practical insights and clear explanations, making it a go-to resource for anyone interested in understanding how AI is transforming the world of FinTech.

“Education should not be a luxury. By pricing the book at $1, I aimed to ensure that cost wouldn’t be a barrier for anyone who wants to learn. The more people understand these technologies, the better equipped they will be to navigate and contribute to the future of digital finance,” Harsh added.

Takeaways for the FinTech Industry

Harsh ended his session at MPC 2024 with actionable takeaways for FinTech companies: staying ahead of fraud trends, implementing strong control measures, and automating compliance processes. He emphasized the importance of staying vigilant and building a strong data foundation, as everything in FinTech is built on top of it.

“In this constantly evolving landscape, staying vigilant and adapting quickly are the keys to success. FinTech companies that fail to keep pace with regulatory changes or fraud trends risk more than just financial loss—they risk losing the trust of their customers,” Harsh concluded.

As the FinTech industry continues to grow and evolve, Harsh Daiya’s insights at MPC 2024 and his contributions through his book will undoubtedly help shape the future of risk management and compliance.