1. Overview of Guidance

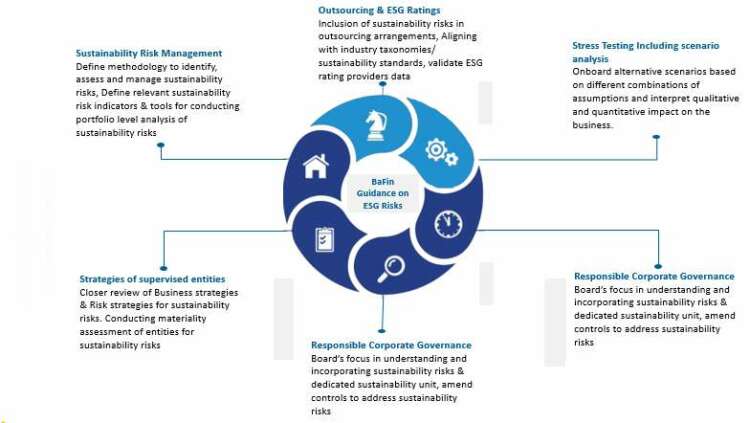

BaFin has conducted consultation during early part of 2020 and further published guidance notice with non-binding recommendations to supervised organizations to integrate climate related risks into risk identifications, management, and control processes. Recommendations from BaFin guidance notice are broadly categorized under 6 pillar dimensions.

2. Implications of BaFin guidelines to EU Banks

Though the guidance paper doesn’t recommend any specific timeline for adherence , it is essential for institutions to develop core capabilities essential to address these 6 dimensions of impact.

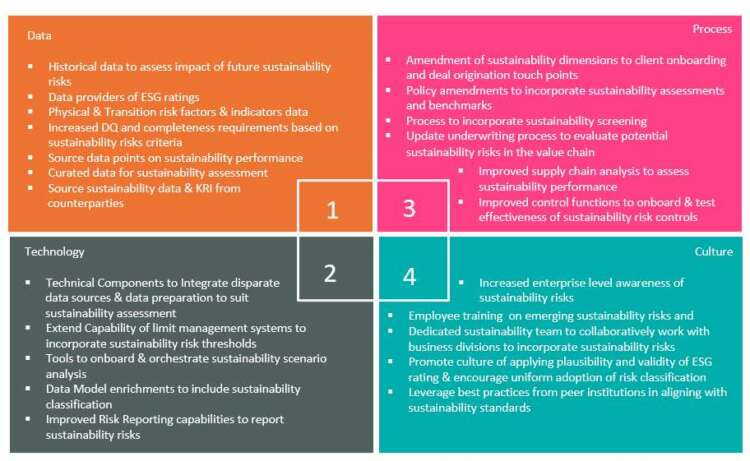

Implementation of BaFin guidance requires supervisory entities to develop key capabilities which has an impact across data , process, technology, and culture.

Majority of these Key interventions could be achieved through common capabilities of risk management applicable to any enterprise risks but carefully enhanced to match with sustainability risks management

Since BaFin recommends considering sustainability risk as cross cutting risk category and not as separate risk type, institutions need to carefully plan for integrating sustainability dimensions in identification, assessment, measurement, monitoring and reporting stages of ERM framework

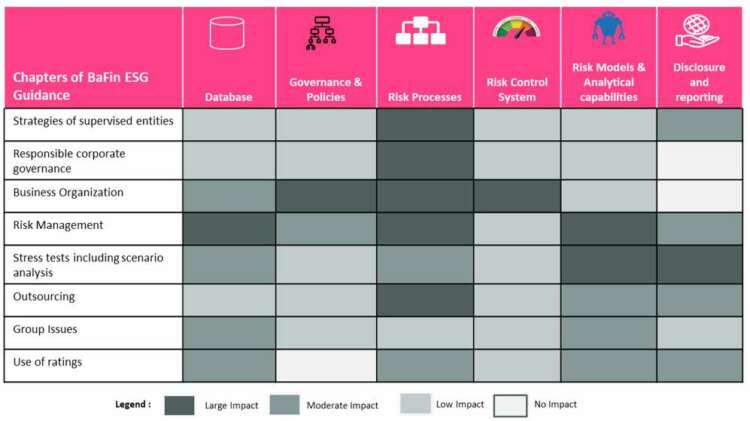

Recommendations from BaFin span across complete sustainability risk management value chain and need to be approached by institutions in structured manner. As a first step, it is important to conduct capability assessment and mapping for each of the principal requirements. It will provide necessary inputs for planning strategic programs for managing sustainability risks.

Depending on organization’s size and maturity of their current risk management frameworks, firms can consider more granular mapping as part of impact assessment. As suggested by TCFD recommendations, it is important to categorize type of impact and overlap with any ongoing risk management initiatives and potential enhancements required. Any newer capabilities required dedicatedly for sustainability risks need to be prioritized.

Below is the high-level impact mapping created for chapters of BaFin’s guidance on sustainability risks.

3. Overlap with TCFD Guidance

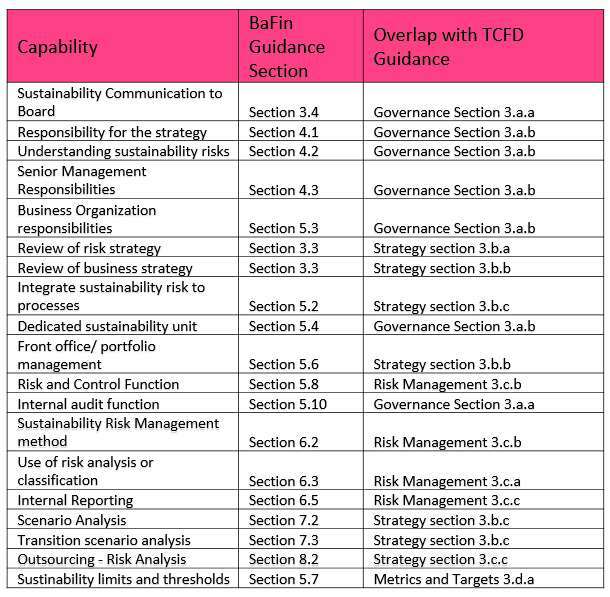

BaFin guidance is structurally broadly aligned to the work done globally including TCFD covering key pillars of Strategy, Governance, Risk Management, and Metrics & targets. There are numerous overlaps with TCFD guidance & complying with BaFin ESG guidance.

For Banks & Financial institutions in Germany which are planning to comply with TCFD guidance on disclosing climate risk , we strongly recommend conducting a gap assessment to understand overlapping capabilities and focus on enhancing incremental capabilities.

Significant attention must be devoted to understanding intricacies of potential reputational risks in non-disclosure of climate risk reports. For effective reporting & insight generation around ESG risks it is very important to evaluate industry taxonomy like EU Taxonomy of sustainable activities and assess how their sustainability categorization is aligned, how much percentage of portfolio is taxonomy aligned. Early assessment of taxonomy alignment will give competitive edge over other firms in terms of market position & raising liquidity.

4. Conclusion – What are Next Steps ?

- Based on our expertise & understanding of TCFD and BaFin guidance we see that there is large scope of overlap between core compliance components.

- We realize that the impact of guidance is throughout value chain of ESG risk management, and it is practical for enterprises to assess current risk management systems and capabilities and prepare a road map for implementing additional capabilities.

- Through high level assessment of guidance for impact dimensions , we foresee that there will be major impact on risk management processes and risk modeling and firms can prioritize & equip their 2nd LOD teams to take care of additional obligations.

- While most of the organizations today rely on ESG rating providers for comparative assessment of ESG performance & BaFin guidance clearly calls out plausibility checks of data inputs shared by third-party ESG rating providers. We feel that this obligation will revamp current practice and methodology adopted by firms when using ESG data from providers.

- In terms of ESG integration , it will not be a simple & straight forward experience to engage with wide variety of stakeholders from multiple business lines for ex. Customer onboarding, credit origination, Investments teams, it is important for firms to encourage ESG risks through trainings and collaboration across sustainability, business divisions, climate risk modeling, risk policy management team, regulatory teams. Early adopters will benefit from competitive advantage and reap comparative benefits as industry view on ESG performance grows manifold.

Author’s Bio

Sudalaimuthu Gurusamy is a Domain Consultant with the Risk Management practice of the Banking and Financial Services (BFS) business unit at Tata Consultancy Services (TCS). During his 13 years of experience in consulting, he has worked on several global risk and compliance engagements as Risk Domain Consultant/Senior Business Analyst.

A GARP certified Financial Risk Manager™ and Sustainability & Climate Risk™ professional, Sudalaimuthu holds a master’s degree in Business Administration from the Anna University, Chennai, India. His risk consulting experience revolves around Credit risk Transformation, Risk Data Transformation Initiatives, BCBS 239, BASEL II, BASEL III, Liquidity risk management, Loan loss forecasting and provisioning, and risk regulatory reporting. Recently he is working on developing risk solutions to cater to emerging risks domains including operational resiliency & climate risk.